This article is transferred from [Sino-Singapore Jingwei];

Sino-Singapore Jingwei August 5th (Wang Yongle) Good news! The fuel surcharge has finally been lowered after the “five consecutive increases”. Starting today (5th), you can save up to 60 yuan on air tickets.

Fuel surcharge reduced after “five consecutive increases”

According to incomplete statistics, recently, at least Hainan Airlines, Kunming Airlines, China Southern Airlines, Guilin Airline, West Air, Sunan Ruili Airlines, China Eastern Airlines, Shanghai Airlines, Colorful Guizhou Airlines and other domestic airlines have officially announced or notified the booking platform to adjust the fuel surcharge for domestic flights from 0:00 on August 5 (the date of ticket issuance). charging standard.

Screenshot of China Southern Airlines WeChat ID

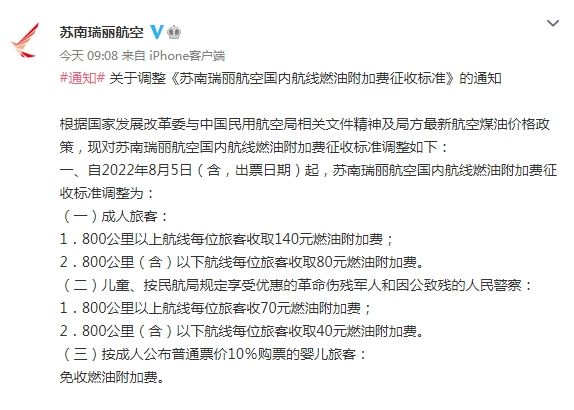

Screenshot of Sunan Ruili Airlines Weibo

From the notice of airlines, this fuel surcharge reduction is based on the spirit of the relevant documents of the National Development and Reform Commission and the Civil Aviation Administration of China. Fang’s latest aviation kerosene price policy adjustment.

The specific policies for price adjustment include that the fuel surcharge for routes with a distance of less than 800 kilometers (inclusive) is 80 yuan per segment; the fuel surcharge for routes with a distance of more than 800 kilometers is 140 yuan per segment; 8 For domestic tickets sold before August 4 (inclusive), if the change is made after August 5 (inclusive), the collected fuel surcharge will not be refunded or made up.

On July 29, Longzhong Information once issued a document saying that the international oil price is in a downward trend, and the price of jet fuel has been lowered as a whole.

“According to relevant regulations, there is a linkage mechanism between the fuel surcharge of civil aviation domestic routes and the price of aviation kerosene, that is to say, the adjustment of the fuel cost of the air ticket is linked with the change of the price of aviation kerosene. When the price of kerosene changes from the benchmark price (5,000 yuan/ton), the airline can adjust the fuel surcharge according to the corresponding adjustment mechanism. With the weakening of international oil prices, the price of aviation kerosene has retreated after a continuous rise. The company has lowered the fuel surcharge in accordance with the provisions of the linkage mechanism.” Cheng Chaogong, chief researcher of Tongcheng Research Institute, said in an analysis of Sino-Singapore Jingwei.

Sino-Singapore Jingwei noted that this is the first time the fuel surcharge has been lowered since the resumption of collection in February this year, and it has been raised five times before.

From a review, on January 5 this year, domestic routes cancelled the collection of fuel surcharges. On February 5th, the fuel surcharge will be levied again, with 10 yuan and 20 yuan respectively for the segments of 800 kilometers and below and above; from March 5th, 20 yuan and 40 yuan respectively; from April 5th, 50 yuan respectively yuan and 100 yuan; from May 5th, 60 yuan and 120 yuan respectively; from June 5th, 80 yuan and 140 yuan respectively; from July 5th, 100 yuan and 200 yuan, respectively The highest level since the fuel surcharge was introduced in 2000.

From the perspective of the adjustment standard, after the fuel surcharge is lowered, passengers can save up to 60 yuan by buying a ticket after August 5, compared to before the reduction.

Airlines suffered a “blood loss” in the first half of the year

The airline companies had a very difficult life in the first half of the year.

At the press conference of the Civil Aviation Administration held on July 12, Sun Wensheng, deputy director of the General Department of the Civil Aviation Administration, revealed that in the first half of the year, civil aviation was facing unprecedented difficulties. In the first half of the year, when the number of daily flights was the lowest, there were only 2,967 flights, which was only 17.8% of the same period in 2019.

As of press time, a number of airlines have released performance forecasts for the first half of the year, all of which are in a state of loss. Judging from the upper limit of net profit, Air China, China Eastern Airlines, ST Hainan Airlines, and China Southern Airlines all have pre-losses of over 10 billion yuan, and the four companies have a total pre-loss of 57.65 billion yuan, exceeding the 36.238 billion yuan loss in 2021.

As for the reasons for the loss, China Southern Airlines pointed out that the domestic civil aviation industry has been affected by multiple shocks such as repeated epidemics, high oil prices, and the devaluation of the RMB.

China Eastern said that the company, headquartered in Shanghai, has experienced severe challenges from the impact of the epidemic. At the same time, the sharp rise in international oil prices and the depreciation of the RMB against the US dollar have further aggravated the company’s cost pressure.

Air China also stated that since the beginning of this year, the domestic epidemic has spread in many places, resulting in a significant reduction in domestic routes investment; international routes investment continues to be limited. Rising oil prices and exchange rate fluctuations further aggravated the difficulty of improving the company’s efficiency, and the operating performance of investment companies related to the main business was also affected.

And ST Hainan Airlines said that the company’s loss was mainly due to operating losses and financial exchange losses.

Will the fuel surcharge cut stimulate travel and boost airline performance? Cheng Chaogong said that the decline of fuel surcharges can reduce the travel cost of civil aviation passengers to a certain extent, and has a certain stimulating effect on the demand for non-public travel such as tourism and vacation.

“Fuel costs account for 30% to 40% of the total cost of airlines, and the continuous rise in aviation kerosene prices has brought greater pressure to airline operations. Therefore, the decline in oil prices will To a certain extent, it will alleviate the cost pressure of airlines, which will have a certain positive effect on the improvement of performance fundamentals.” Cheng Chaogong further analyzed.

In addition, Huatai Securities recently released a report saying that the epidemic situation is improving marginally, the overall epidemic prevention policy is on the trend of relaxation, aviation demand is expected to continue to recover due to the peak season of summer transportation, and the probability of greater pressure on oil prices and foreign exchange is relatively high. Small, airline profits are expected to improve. (Sino-Singapore Jingwei APP)