China Economic Net, Beijing, March 22. Today, Liaoning He’s Eye Hospital Group Co., Ltd. (hereinafter referred to as “He’s Ophthalmology”, 301103.SZ) was listed on the GEM of the Shenzhen Stock Exchange. As of today’s close, He’s Ophthalmology reported 49.50 yuan, an increase of 16.47%, with a turnover of 979 million yuan, a turnover rate of 65.02%, an amplitude of 22.73%, and a total market value of 6.017 billion yuan.

He’s Ophthalmology is a group-type chain medical institution that integrates medicine, teaching and research, adopts a three-level eye health medical service model, and is committed to the whole life cycle eye health management. The company’s main business is to provide ophthalmic specialist diagnosis and treatment services and optometry services for patients with eye diseases. Diagnosis and treatment services include common blinding eye diseases such as cataract, glaucoma, and vitreoretinopathy, as well as special diagnosis and treatment services such as dry eye and traditional Chinese medicine. Clinic services and optometry services.

Before this issuance, He Wei directly held 25.62% of the company’s shares, He Xiangdong directly held 15.37% of the company’s shares, and Fu Lifang directly held 10.25% of the company’s shares. Indirectly controls 6.48% of the company’s shares, and indirectly controls 5.59% of the company’s shares by serving as the executive partner of Gonghao Technology, Gongfu Technology, and Gongxing Technology. He Wei and He Xiangdong are brothers, He Wei and Fu Lifang are husband and wife, and He Wei, He Xiangdong, Fu Lifang signed the “According to Action Agreement”, so He Wei, He Xiangdong, Fu Lifang jointly control 63.31% of the company’s shares , is the controlling shareholder and actual controller of the company.

On August 19, 2021, the first meeting of He’s Ophthalmology was held, and the main questions asked at the 50th review meeting of the GEM Listing Committee in 2021:

1. The issuer and the Central Enterprise Poverty Alleviation Fund jointly funded the establishment of Xiongan Management Company. The representative of the issuer should explain: (1) the purpose, background and business logic of establishing Xiongan Management Company; (2) whether the guaranteed minimum return clause and the repurchase clause stipulated in the investment agreement comply with the current laws and regulations, and whether it harms the issuer and the small and medium-sized enterprises. legitimate rights and interests of investors. Sponsor representatives are requested to express a clear opinion.

2. The issuer’s representative is requested to explain the rationality of the issuer’s optometry business growth based on factors such as the regional market competition pattern for optometry services, the equipment output of tertiary institutions, the per capita income level of optometrists, and the number of optometrists served per capita. . Sponsor representatives are requested to express a clear opinion.

3. During the reporting period, the issuer had a number of medical disputes and administrative penalties. The representative of the issuer is requested to explain whether the medical service quality control system is established and sound, and whether the relevant internal control system is effectively implemented. Sponsor representatives are requested to express a clear opinion.

The sponsor (lead underwriter) of He’s Ophthalmology is Zhongyuan Securities Co., Ltd., and the sponsor representatives are Zhong Jiangang and Feng Jiangtao.

He’s Ophthalmology issued 30,500,000 shares this time, accounting for 25.09% of the total share capital after the issuance. The issue price was 42.50 yuan per share, and the total amount of funds raised was 1,296,250,000 yuan. After deducting the issuance expenses, the net proceeds The amount is 1,164,311,300 yuan.

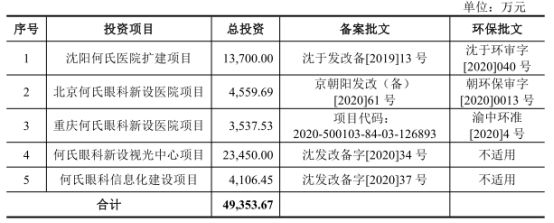

The actual net fundraising of Ho’s Ophthalmology is 670.7746 million yuan more than the original net fundraising. The company’s prospectus disclosed on March 16, 2022 shows that the company plans to raise funds of 493.5367 million yuan, which will be used for the expansion project of Shenyang He’s Hospital, the new He’s Eye Hospital in Beijing, and the new He’s Eye Hospital in Chongqing. He’s ophthalmology newly established optometry center project, He’s ophthalmology informatization construction project.

The total issuance cost of He’s Ophthalmology is 131,938,700 yuan, and Zhongyuan Securities Co., Ltd. received a sponsorship and underwriting fee of 99,904,900 yuan.

From 2018 to January to June 2021, the operating income of He’s Ophthalmology was 613.7277 million yuan, 745.5638 million yuan, 838.4733 million yuan and 464.6200 million yuan, respectively, and the net profit attributable to ordinary shareholders was 56.1047 million yuan, RMB 80,601,200, RMB 100,235,900, RMB 58,993,400, net profits attributable to ordinary shareholders after deducting non-recurring gains and losses were RMB 53,933,300, RMB 67,136,500, RMB 89,207,700, and RMB 58,158,800, respectively. Cash flow from operating activities The net amounts were RMB 81,818,800, RMB 120,399,900, RMB 169,744,000, and RMB 113,030,600 respectively.

As of the signing date of the listing announcement, the company’s 2021 annual financial report has been reviewed by Rongcheng Certified Public Accountants (special general partnership), and Rongcheng Zhuanzi [2022] No. 110Z0020 “Review Report” has been issued. Reviewed by Rongcheng, the company’s operating income in 2021 is 962.4514 million yuan, an increase of 123.9781 million yuan year-on-year, an increase of 14.79% compared with 2020; the net profit attributable to ordinary shareholders, after deducting non-recurring gains and losses attributable to ordinary shareholders The net profit was RMB 86.3643 million and RMB 75.8149 million respectively, a decrease of RMB 13.8716 million and RMB 13.3928 million, a decrease of 13.84% and 15.01% year-on-year.

According to the company’s preliminary estimate, the company’s operating income from January to March 2022 will be 243.3458 million yuan to 268.9612 million yuan, an increase of 15.70% to 27.88% over the same period of the previous year, and the net profit attributable to ordinary shareholders is 31.9091 million yuan to 35,267,900 yuan, an increase of 14.16% to 26.18% over the same period of the previous year; net profit attributable to ordinary shareholders after deducting non-recurring gains and losses was 31,640,600 yuan to 34,971,200 yuan, an increase of 15.43% to 27.58% over the same period of the previous year.