Inexperienced, donated to the hospital, Younger quit the big health industry. On the evening of May 17, Youngor announced that it would donate to the hospital that has recently completed the acceptance inspection and withdraw from the big health industry. In this regard, the reason given by Youngor is that there is a lack of operation teams and experience in related industries. If you continue to invest, there may be an imbalance between input and output.

In the eyes of industry insiders, the medical industry has strong professionalism, large investment, long return period and strict supervision. With the advancement of the national medical system reform, the clothing enterprise Youngor does not have an operation management team and certain experience. Forced layout of input and output is bound to be unbalanced.

Withdrawing from the health industry, Younger throws the burden?

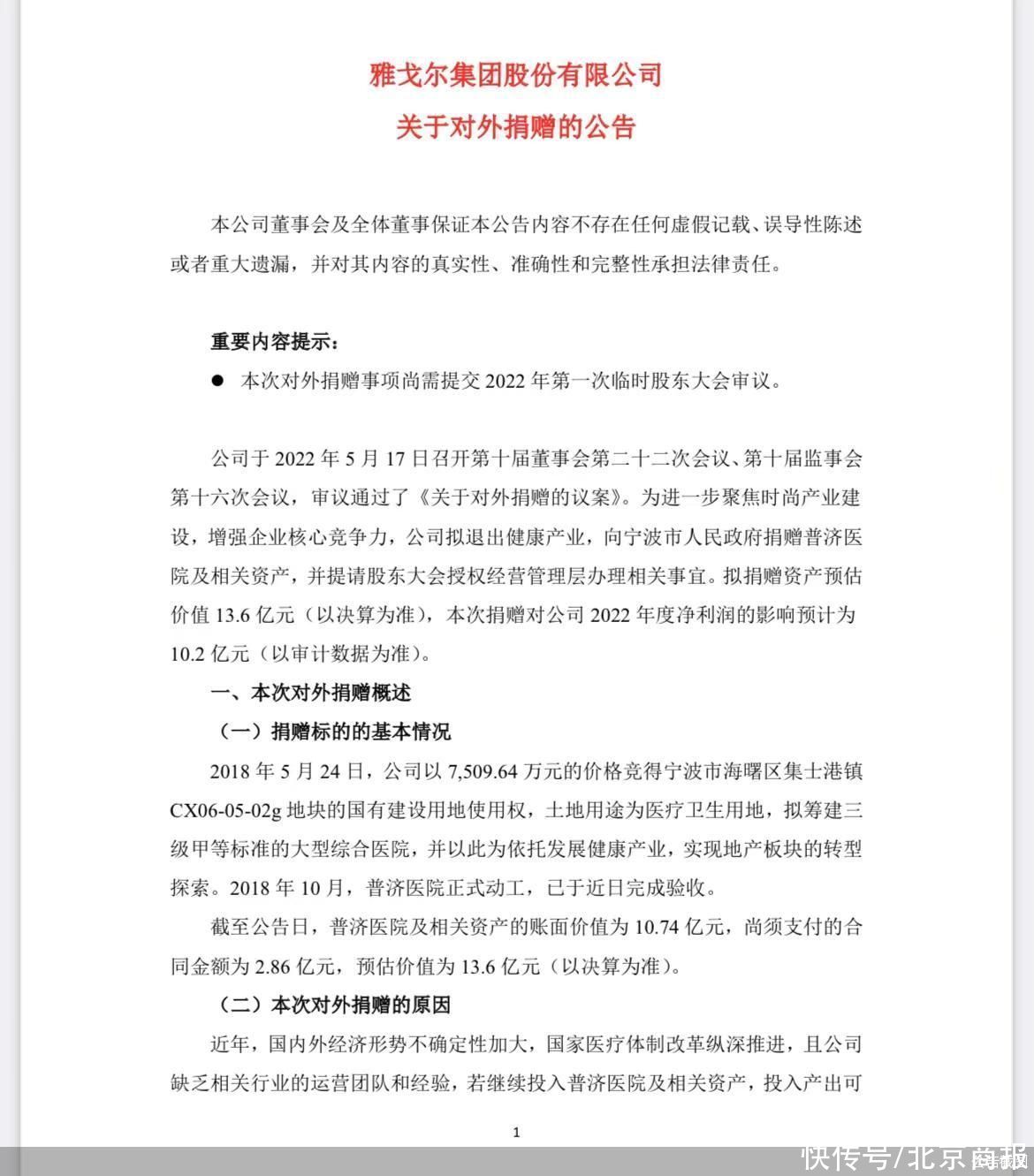

Youngor mentioned in the announcement that in order to further focus on the construction of the fashion industry and enhance the core competitiveness of the company, the company plans to withdraw from the health industry, donate Puji Hospital and related assets to the Ningbo Municipal People’s Government, and submit it to the general meeting of shareholders Authorize the management to handle related matters. The estimated value of the assets to be donated is 1.36 billion yuan (subject to the final accounts), and the impact of this donation on the company’s net profit in 2022 is expected to be 1.02 billion yuan.

About Youngor’s layout of the health industry, it can be traced back to 2015. At that time, Youngor established the Youngor Health Industry Fund with its own funds, thereby announcing its official entry into the field of “big health”. In 2018, Youngor won the state-owned construction land use right of the CX06-05-02g plot in Jishigang Town, Haishu District, Ningbo City at a price of 75.0964 million yuan. Large-scale general hospitals, and relying on this to develop the health industry and realize transformation and exploration.

According to public reports, after obtaining the land, Youngor plans to build a top-three standard hospital with a construction area of 236,160 square meters and 1,600 beds. Echoing the hospital is the planned supporting elderly care center. Youngor plans to build an elderly care center on a plot adjacent to the hospital in 2020, with a planned area of 150,000 square meters and 1,200 rooms. Unexpectedly, when the hospital completed the acceptance, it was donated, and Younger also withdrew from the big health industry.

In this regard, medical expert Zhao Heng analyzed that for Youngor, the difficulty of cross-border is mainly due to the reform of medical services, especially after the reform of the medical insurance payment system, hospitals are no longer a high-profit industry. An industry is no longer attractive.

In the opinion of Deng Yong, a professor of law at Beijing University of Traditional Chinese Medicine, Youngor’s donation of hospital assets not only wants the company to focus on its main business, but also concentrate resources and management teams, so as to adjust the existing industrial structure and make the company stable and healthy. In addition to development, medical care is an industry with strong professionalism, large investment, long return period, and strict supervision. The current epidemic has repeatedly increased uncertainty. In addition, with the advancement of the national medical system reform, Youngor, which produces clothing, does not have an operation management team and certain experience.

“Youngor’s donation of hospital assets this time is also throwing off the burden and stopping losses in time. If you don’t have experience in operation and management, it will easily lead to an imbalance of input and output. In addition, from the perspective of tax law, Youngor’s donation can A large part of the tax payment.” Deng Yong added.

For this donation and withdrawal from related industries, Youngor stated in the announcement that in recent years, the uncertainty of the domestic and foreign economic situation has increased, the reform of the national medical system has been advanced in depth, and the company lacks operation teams in related industries. And experience, if we continue to invest in Puji Hospital and related assets, the input and output may be unbalanced to a large extent, which is not conducive to the company’s focus on capital and energy to develop its main business.

Splitting off the investment business and returning to the main business

Of course, in addition to its own lack of operational experience, the strategy of returning to the main clothing business that Youngor has emphasized in recent years has also become its exit from the big health industry. one of the influencing factors.

In 2019, Youngor released the “Proposal on the Adjustment of Investment Strategy”, stating that in order to achieve the goal of maximizing value, the company plans to make major adjustments to the development strategy, and will further focus on the development of the main clothing business in the future. In addition to making financial investments and continuing to fulfill investment commitments, the company will no longer carry out financial equity investments in non-main business areas, and will choose to dispose of existing financial equity investment projects.

At the same time, Youngor also disclosed in its 2021 financial report that the company’s core business is the fashion industry with brand clothing as the main body. Brand competitive advantage, strengthen the construction of industrial chain, explore new business models, increase investment in science and technology, and build a world-class fashion group.

Under the influence of the strategy of returning to the main business, Youngor not only withdrew from the health industry, but also continued to divest investment and other businesses. On the evening of May 5, 2022, Youngor announced that it plans to sell its 1.32% stake in the National Pipeline Network Group United Pipeline Co., Ltd. at a price of 3.361 billion yuan. At the end of August 2020, Youngor announced that as of the close of trading on August 31, the company had sold 97.6592 million shares of Bank of Ningbo, with a transaction amount of 3.224 billion yuan, resulting in an investment income of 1.603 billion yuan and a net profit of 901 million yuan.

Industry insiders said that for Youngor, it has certain experience and operational capabilities in the apparel industry, and at the same time has a relatively mature brand. There are certain benefits to boosting.

A reporter from Beijing Business Daily conducted a telephone interview with Younger on the issue of the exit from the big health industry, but the call has not been answered as of press time.

Beijing Business Daily reporter Zhang Junhua