Reporter Huang Shougen

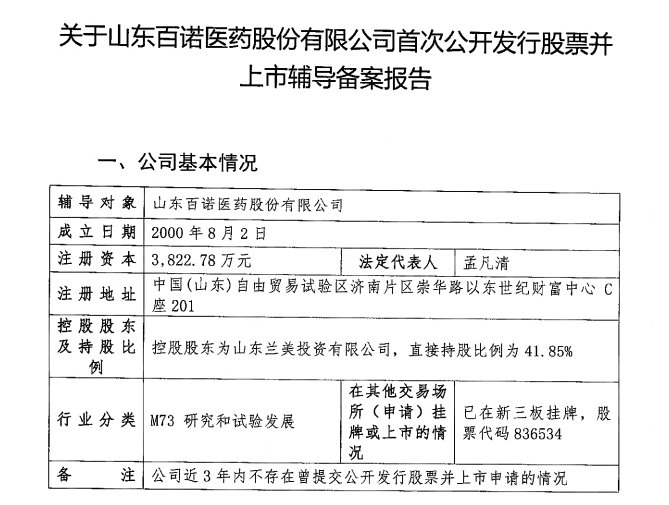

A few days ago, the online service service platform of the China Securities Regulatory Commission disclosed that Shandong Bainuo Pharmaceutical Co., Ltd. The filing report, the filing time is April 24, and the guidance brokerage is CICC. This means that this drug research and development company from Jinan, which has been listed on the New Third Board, has officially started its IPO journey.

Mainly engaged in medical technology transfer and development

According to public information, Biopharma was established in 2000 In August 2008, the registered capital was 38.2282 million yuan, and the legal representative was Meng Fanqing. The registered place was located in Century Fortune Center, east of Chonghua Road, Jinan Area, China (Shandong) Pilot Free Trade Zone.

The company specializes in the research and development, production and sales of new pharmaceutical products. The technical achievements in the preclinical research stage will be transferred to other pharmaceutical companies, and the relevant technology transfer service fees will be charged.

The company’s R&D projects cover a wide range of fields, including antibacterial, digestive system, anti-tumor, circulatory system, nervous system, urinary system, mental disorders, respiratory system drugs and other drugs. The company also has research and development on drugs for the treatment of erectile dysfunction.

The company’s official website said that the company has successfully developed more than 330 new drugs of various types, more than 240 products have obtained new drug certificates or production approvals, and more than 110 intellectual property rights.

At present, the actual controllers of Bainuo Pharmaceutical are Meng Fanqing and Jiao Mei. Meng Fanqing directly holds 13.361 million shares of the company, accounting for 34.95% of the company’s total share capital. In addition, Meng Fanqing and Jiao Mei controlled 15.999 million shares of the company by controlling Shandong Lanmei Investment Co., Ltd., and Meng Fanqing controlled 3.952 million shares of the company by controlling Jinan Junhe Enterprise Management Consulting Partnership (Limited Partnership). The company shares controlled by the husband and wife together account for 87.14% of the company’s total share capital.

Pien Tze Huang, Guizhou Bailing, etc. were all its customers.

In 2016, Paramedic was listed on the New Third Board. According to Wind data, in the first two years of listing, the company’s revenue continued to decline. In 2016 and 2017, the company achieved revenue of 51 million yuan and 28 million yuan, a year-on-year decrease of 31.26% and 31.81%, and the net profit was also in 2017. Turn from profit to loss.

In 2018, Bainuo Pharmaceutical’s performance has entered a steady growth track. From 2018 to 2020, the company achieved revenue of 65 million yuan, 87 million yuan, and 119 million yuan, an increase of 129.03% in three years. , 34.55%, 37.04%, corresponding to net profit of 4 million yuan, 09 million yuan, and 13 million yuan.

In 2021, Bainuo’s performance will explode, with revenue of 254 million yuan, a year-on-year increase of 113.10%; net profit of 83.7117 million yuan, a year-on-year increase 562.88%, gross profit margin reached 72.91%. The total research and development expenses are 60.235 million yuan, and the research and development intensity is 23.69%. In terms of products, the technology transfer and development segment achieved a revenue of 225 million yuan, accounting for 88.58% of the total revenue, and the sales revenue was 19 million yuan, accounting for 7.6% of the total revenue.

In terms of specific customers, as a company mainly engaged in technology transfer and development, most of Bainuo’s customers are top 100 domestic pharmaceutical companies or listed companies. The stock transfer prospectus at that time showed that well-known domestic pharmaceutical companies Guizhou Bailing, Weigao Pharmaceutical, Xinhua Pharmaceutical, Yangzijiang Pharmaceutical, etc. were all corporate customers or had signed technology transfer contracts. Pien Tze Huang, which had soared before, also signed a technology commissioned development contract with the company.

Just proposed a children’s drug with increased power

It is worth noting that before this counseling and filing, Paramedic just disclosed its preparations on April 15. Conduct stock issuance.

Benuo Pharmaceuticals said that in order to maintain the continuous growth of the company’s business scale and obtain follow-up financial support for strategic development, it will quickly introduce pharmaceutical varieties with good market prospects to the market to enhance the company’s profitability. At the same time, further optimize the company’s capital structure and enhance the company’s capital strength and anti-risk capabilities. The company plans to issue shares to raise funds for the research and development of children’s medicines and the construction of a sustained and controlled release preparation platform.

The target of the directional issuance is Shandong Shanke Innovation Equity Investment Co., Ltd. (referred to as “Shanke Venture Capital”) and Jinan Trivalent Rongzhi Intellectual Property Equity Investment Partnership Enterprise (limited partnership), the price of issuing shares is 52.79 yuan per share. Among them, Shanke Venture Capital invested 60 million yuan to subscribe for 1,136,600 shares, and Triprice Rongzhi invested 20 million yuan to subscribe for 378,900 shares.

The total amount of funds raised by fixed increase is 80 million yuan, of which 60 million yuan is invested in the research and development of children’s medicines, and 20 million yuan is invested in the construction of the sustained and controlled release preparation platform. After the issuance, Shandong Lanmei Investment Co., Ltd.’s shareholding ratio will drop to 40.26%, and Meng Fanqing’s shareholding ratio will drop to 33.62%.