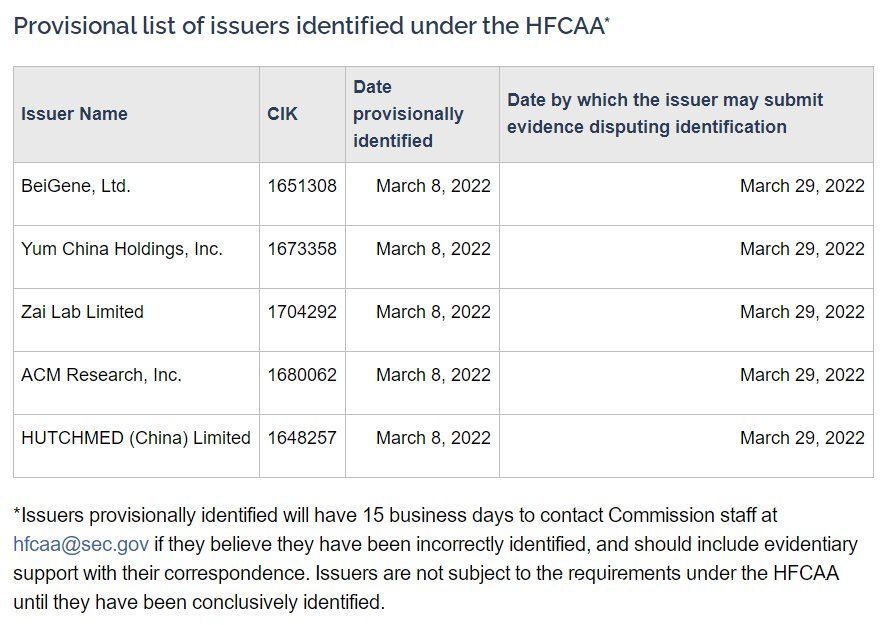

On March 10, according to relevant media reports, the U.S. Securities and Exchange Commission (SEC) added five companies to the tentative list of the “Foreign Company Accountability Act” on March 8, including BeiGene, Zai Lab Pharmaceuticals, Chi-Med, Shengmei Semiconductor, Yum China.

It is understood that the “Foreign Company Accountability Act” is a bill passed by the U.S. Congress, which restricts foreign companies listing in the United States. Make additional disclosure requests. Approved by the U.S. Senate in May 2020. It was approved by the House of Representatives on December 2. The Foreign Company Accountability Act requires foreign issuers to be prohibited from trading in the U.S. if they fail to meet the requirements of the U.S. Public Company Accounting Oversight Board for inspections of accounting firms for three consecutive years.

Beijing and Zai Lab responded today to the fact that the company was identified by the SEC as having a risk of delisting.

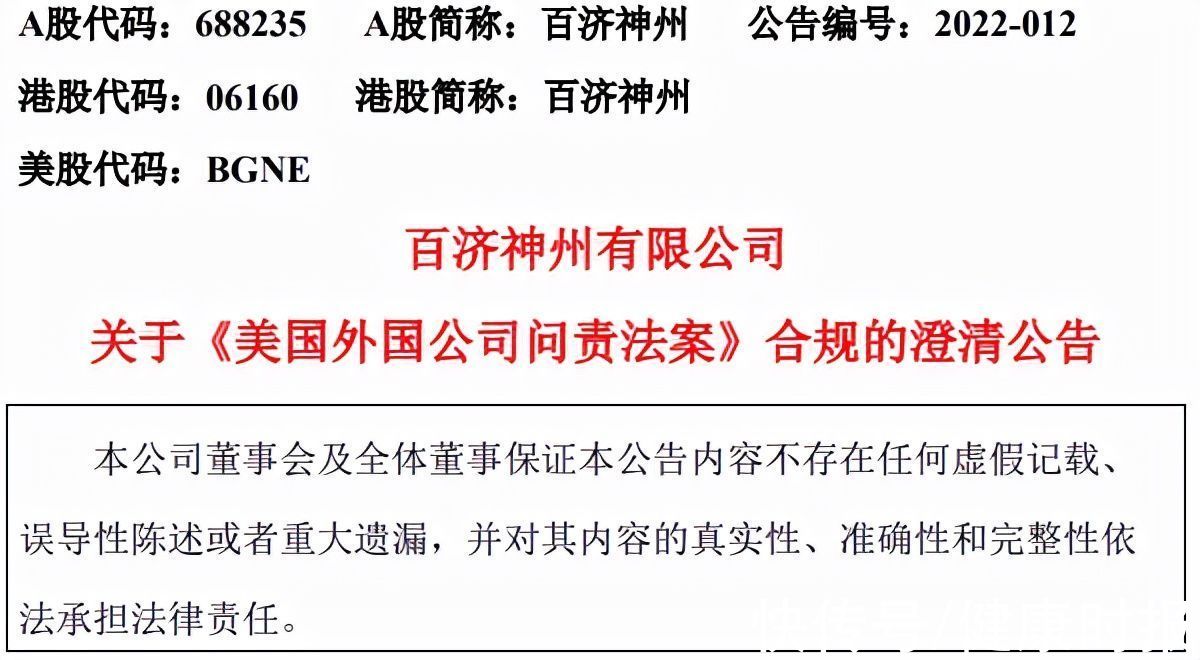

On March 11, BeiGene issued a clarification announcement on compliance with the U.S. Foreign Company Accountability Act, saying that the temporary designation list was an administrative measure taken by the SEC, indicating that the After several companies recently released their 2021 financial results, the SEC began to designate companies that use auditors that have not been reviewed by the PCAOB.

On March 11, Zai Lab issued an announcement saying that the company is not yet aware of the SEC’s identification of it and the other four Due to the company’s reasons, the SEC’s temporary determination does not indicate that Zai Lab will be delisted from the Nasdaq exchange.

On March 11, the China Securities Regulatory Commission also issued a decision on the identification of five US-listed companies on March 11. Urgent reply for “relevant issuers” at risk of delisting. The China Securities Regulatory Commission said: We have noticed this situation. This is a normal step for U.S. regulators to enforce the Foreign Company Accountability Act and related implementing rules. We have stated our position on the implementation of the Foreign Company Accountability Act many times before. We respect that foreign regulators strengthen the supervision of relevant accounting firms in order to improve the quality of financial information of listed companies, but firmly oppose the wrong practice of some forces politicizing securities supervision. We have always adhered to the spirit of openness and cooperation, and are willing to solve the problem of inspections and investigations of relevant firms by the US regulatory authorities through regulatory cooperation, which is also in line with international practices.

The China Securities Regulatory Commission stated: Recently, the China Securities Regulatory Commission and the Ministry of Finance have continued to work with the US Public Company Accounting Oversight Board ( PCAOB) to conduct communication and dialogue, and made positive progress. We believe that through joint efforts, the two sides will be able to make cooperation arrangements as soon as possible in line with the legal provisions and regulatory requirements of the two countries, jointly protect the legitimate rights and interests of global investors, and promote the healthy and stable development of the two countries’ markets. (Gao Ruirui)