Sino-Singapore Jingwei, August 5th (Zhang Shunan) Real Biotechnology Co., Ltd. (hereinafter referred to as Real Bio) to the Hong Kong Stock Exchange Submit the prospectus, the sole sponsor is CICC. The listing application shows that Real Bio has not yet had any income; as of May 31, the company has a total of 173 employees.

The raised funds will be used for the core product Azvudine

On August 4, the Hong Kong Stock Exchange disclosed the listing application, showing that Real Bio was developed by Incorporated in the Isles of Man with limited liability, is a R&D-driven biotechnology company dedicated to the development, manufacture and commercialization of innovative drugs for the treatment of viral, oncology and cerebrovascular diseases. The core product, Azvudine, is an innovative drug with broad-spectrum antiviral activity. It has been approved by the State Food and Drug Administration for the treatment of HIV infection and COVID-19 in July 2021 and July 2022, respectively. It is a Chinese company. The first oral direct-acting antiviral drug developed by the State Food and Drug Administration for the treatment of COVID-19.

The listing application stated that azvudine was originally developed by Zhengzhou University. Beijing Xingyu Zhongke Investment Co., Ltd. (Xingyu Zhongke), a company controlled by Mr. Wang, entered into a technology transfer agreement with Zhengzhou University on 16 December 2011 to acquire the intellectual property rights of Azvudine.

After the establishment in 2012 of Henan True Biotechnology Co., Ltd. (hereinafter referred to as Henan True), the operating company of True Bio in China, Xingyu Zhongke and Zhengzhou University further entered into a supplementary agreement on May 14, 2013 to Transfer the relevant intellectual property rights to Henan Zhenzhen. Therefore, Zhengzhou University assigns all rights in the core patents of Azvudine and any existing and future approvals of the State Food and Drug Administration regarding Azvudine to Henan Zhenzhen, and Henan Zhenzhen becomes the sole right holder of such rights. Henan Zhenzhen will be responsible for the follow-up clinical trials and registration work and bear all costs related to the registration and research and development work.

In its future plans, Real Biology said that the use of the listing and fundraising plans to include: the clinical development of the core product Azvudine in the treatment of HIV infection, HFMD and certain types of hematological tumors; the clinical development of Azvudine in the treatment of COVID-19 19 Manufacturing and commercialization (financing the procurement of pharmaceutical raw materials required for the commercial production of Azvudine, and financing the expansion of the production capacity of the Pingdingshan production plant), etc.

Real Bio also mentioned that a comprehensive commercialization plan has been developed to quickly initiate commercial sales of Azvudine. The company has its own production capacity, with an annual production capacity of about one billion tablets of azvudine.

No revenue yet

Real Bio is a pre-revenue company that is primarily engaged in drug research and development activities.

Source: Screenshot of the application form on real creatures

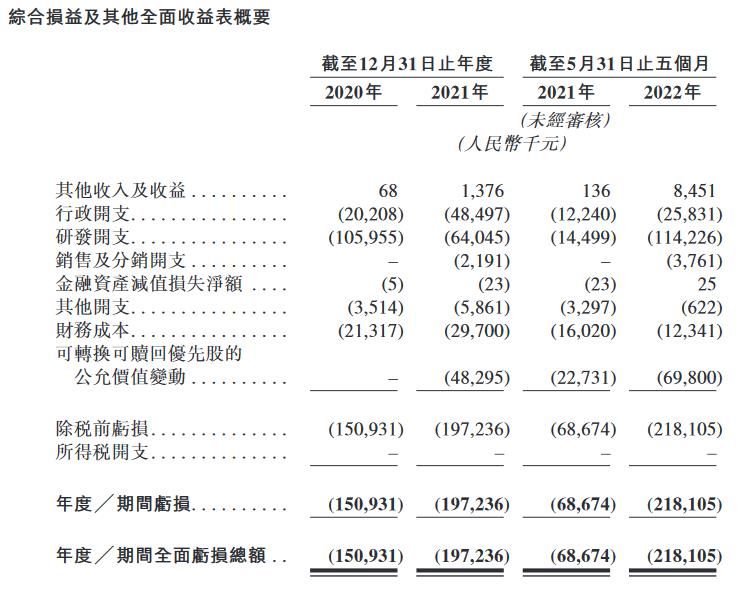

Financial data In 2021, the other income and income of Real Biology was RMB 1.376 million, compared with 68,000 in the same period in 2020; the loss in 2021 was 197 million, and the loss in the same period in 2020 was 151 million. In the first five months of 2022, the company’s other income and gains were 8.45 million yuan, with a loss of 218 million yuan.

In terms of research and development, in 2020, 2021 and as of the end of May 2022, the research and development expenditures of Real Biology are about 106.0 million yuan, 64.045 million yuan and 114.2 million yuan respectively.

As of the end of 2020 and the end of 2021, the company’s net liabilities were 217 million yuan and 390 million yuan, respectively. The company said that it was mainly due to interest-bearing loans and other borrowings and the accounting treatment of preferred shares. Convertible redeemable preferred stock under . As of May 31, 2022, the company’s net debt further rose to 564 million yuan, which was mainly due to the convertible redeemable preference shares classified as non-current liabilities of 8.31 yuan.

According to the listing application, as of May 31, 2022, Real Bio had 173 employees. In terms of R&D personnel, as of May 31, 2022, Real Bio’s internal R&D team consists of 41 members. It plans to further expand its R&D capabilities by attracting talents to join the internal R&D team and seeking local and global research cooperation.

New crown drug trends continue

It is worth mentioning that Kintor Pharmaceutical, Aoxiang Pharmaceutical, China Resources Double Crane, Xinhua Pharmaceutical, etc. Zivudine.

There are not many API manufacturers for Azvudine tablets. In October 2021, Tuoxin Pharmaceutical mentioned in its prospectus that as of that time, only one Tuoxin Pharmaceutical had approved/completed the filing of azvudine APIs in China. Affected by this, the share price of Tuoxin Pharmaceutical once exceeded 200 yuan per share, and the market value increased by about 20 billion yuan compared with the issue price of 19.11 yuan per share.

Aoxiang Pharmaceutical, China Resources Shuanghe, and Xinhua Pharmaceutical have all announced that they can produce azvudine through entrusted production.

In addition to azvudine tablets, which have been marketed with conditions, a number of oral drug projects for COVID-19 in my country have entered the clinical trial stage, including listed companies such as Junshi Bio and Simcere Pharmaceuticals.

The research report of AVIC Securities believes that the new crown pneumonia epidemic is still characterized by repetition and uncertainty, and the demand for the new crown treatment industry chain, especially the small molecule oral drug industry chain, continues to be verified. The focus of the market has shifted from the expectation of R&D progress to the realization of performance. It is recommended to focus on the commercialization capabilities and comprehensive competitiveness of enterprises related to the new crown industry chain.

GF Hong Kong also stated that the hype of azvudine in the secondary market has basically ended, and it is recommended to pay attention to the actual performance of related enterprises in the upstream and downstream of its industrial chain. (Sino-Singapore Jingwei APP)

(The opinions in this article are for reference only and do not constitute investment advice. Investment is risky, and you need to be cautious when entering the market.)

Sino-Singapore Jingwei All rights reserved. Without written authorization, no unit or individual may reproduce, extract or use in other ways.